News

The office of Oklahoma State Treasurer Randy McDaniel releases July's Gross Receipts report. Although July earnings look like they are down they show solid economic growth, according to McDaniel.

Delayed income tax filing extensions are distorting what is really going on. According to McDaniel, Gross Receipts to the Treasury appears negative at first glance due to a reduced bottom line of 15%, but once tax extensions are considered, every revenue stream except income taxes has substantial gains.

“Gross receipts demonstrate a resilient and expanding state economy,” McDaniel said. “Last July’s large income tax collections are an outlier caused by a timing issue.”

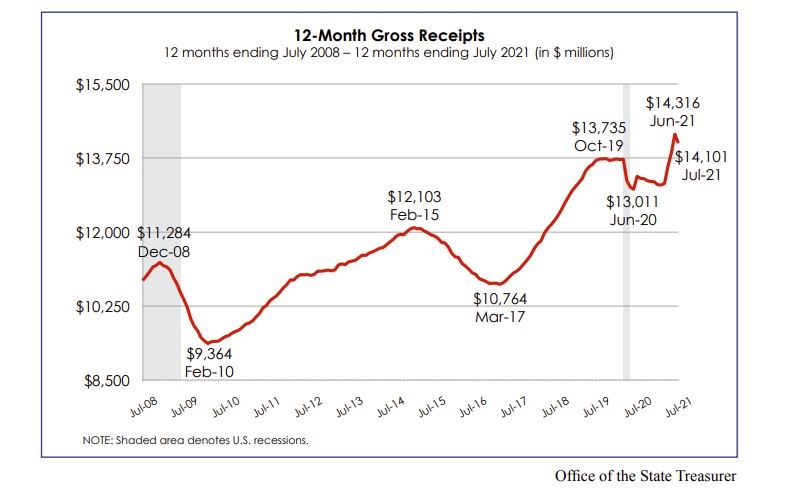

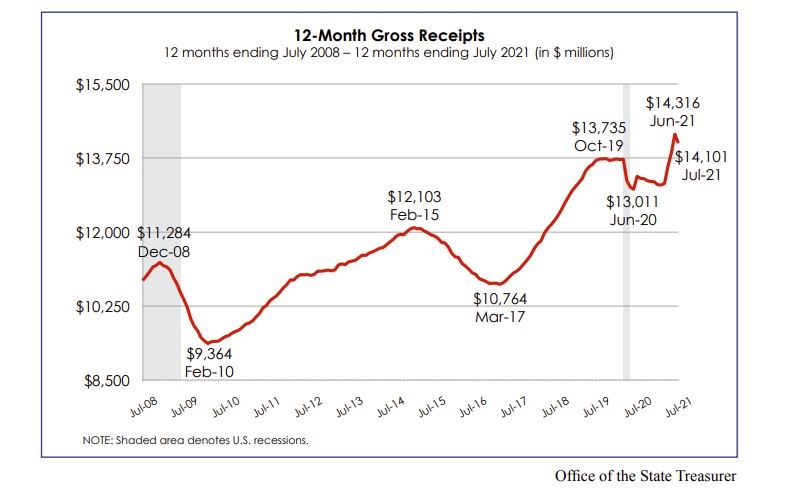

According to the report, July collections total $1.22 billion. Consumer confidence is strong as sales and use tax receipts are 12% higher than a year ago. The gross production tax on oil and natural gas is 260% more than last July. Twelve-month total collections of $14.1 billion reflect a year of economic expansion with every revenue source higher than during the previous 12-month period. This 12-month report is the first in 19 months showing growth in oil and gas production tax collections.

Other Indicators

Also from the report, Oklahoma Business Conditions Index for July anticipates continued economic growth, with the monthly index set at 72.7. Numbers above 50 indicate expansion is expected during the next three to six months.

The June unemployment rate in Oklahoma was reported as 3.7% by the U.S. Bureau of Labor Statistics. The state’s jobless rate was down more than half in June from 8.2% in June 2020.

About Gross Receipts to the Treasury

The monthly Gross Receipts to the Treasury report, developed by the state treasurer’s office, provides a timely and broad view of the state’s economy.

It is released in conjunction with the General Revenue Fund report from the Office of Management and Enterprise Services, which provides information to state agencies for budgetary planning purposes.

The General Revenue Fund, the state’s main operating account, receives less than half of the state’s gross receipts with the remainder paid in rebates and refunds, remitted to cities and counties, and apportioned to other state funds.

Original article posted here: Oklahoma Farm Report