Oklahoma Ag Credit Home Page

Financing

Your Vision

Oklahoma AgCredit is part of the Farm Credit System that supports rural communities and agriculture with reliable and consistent credit, today and tomorrow. We provide loans, leases and financial services to farmers, ranchers, rural businesses and rural homeowners in 60 Oklahoma counties.

Cooperative Structure

Oklahoma AgCredit is a cooperative, owned by the members we serve. This ensures our customers’ needs come first. Our profit can only be used in two ways – retained to build our financial strength or passed on to members through our Patronage Program. Patronage is like an interest rebate and it essentially reduces our members cost of borrowing. We have returned approximately $100 million to our members since 1997.

Oklahoma AgCredit is guided by a Board of Directors elected by members, which ensures borrowers concerns are represented at the top level. The Board designates Appointed Directors to provide additional expertise.

For infomation about our Financial Reports, please click here.

Funding

Oklahoma AgCredit does not take deposits. Although we were created by Congress in 1916, Farm Credit does not receive any government funding or tax dollars.

Farm Credit raises funds by selling debt securities on the nation's money markets through the Federal Farm Credit Banks Funding Corporation. With a AAA-rating, Farm Credit debt enjoys strong demand that results in competitive interest rates on loans for our customer-owners irrespective of financial conditions in the agriculture industry and rural America.

Once the Funding Corporation issues debt securities on behalf of all Farm Credit institutions, Farm Credit's four wholesale banks then fund the individual Farm Credit associations who support farmers, ranchers and rural homebuyers.

CoBank is the funding bank for Oklahoma AgCredit. CoBank provides loans, leases, export financing and other financial services to agribusinesses and rural power, water and communications providers in all 50 states. Learn more at https://www.cobank.com/

Financing Rural Communities and Agriculture

Oklahoma AgCredit is a member of the Farm Credit System that serves every part of agriculture from the smallest operations to the largest – and everything in between. Whether helping a young farm family begin, supporting our veterans as they return home and take up farming or financing U.S. agricultural exports around the globe, Farm Credit is committed to the success of American agriculture.

Our loans and related financial services support farmers and ranchers, farmer-owned cooperatives and other agribusinesses, rural homebuyers and companies exporting U.S. ag products around the globe.

We are part of the rural communities we serve and understand that vibrant rural communities need strong, modern infrastructure. Farm Credit loans finance the rural infrastructure providers that provide reliable power, modern telecommunications, clean water, and other vital community services.

For more than 100 years, Farm Credit has fulfilled its mission – through good times and bad. We remain committed to that mission and evolving to meet the needs of our customers for the next 100 years. Learn more at https://farmcredit.com/

Cybersecurity

Tips for Banking Safely

Consumers increasingly rely on computers, web-enabled devices, and the internet for everything from shopping and communicating to banking and bill-paying. While there are a number of benefits of using web services -- faster and more convenient services, for example -- bank customers should also be aware of the risks.

Oklahoma AgCredit is serious about protecting your personal information and has many layers of security in place to keep your account details safe. Learn what you can do to stay safe online by reading our Cybersecurity Guide.

Management

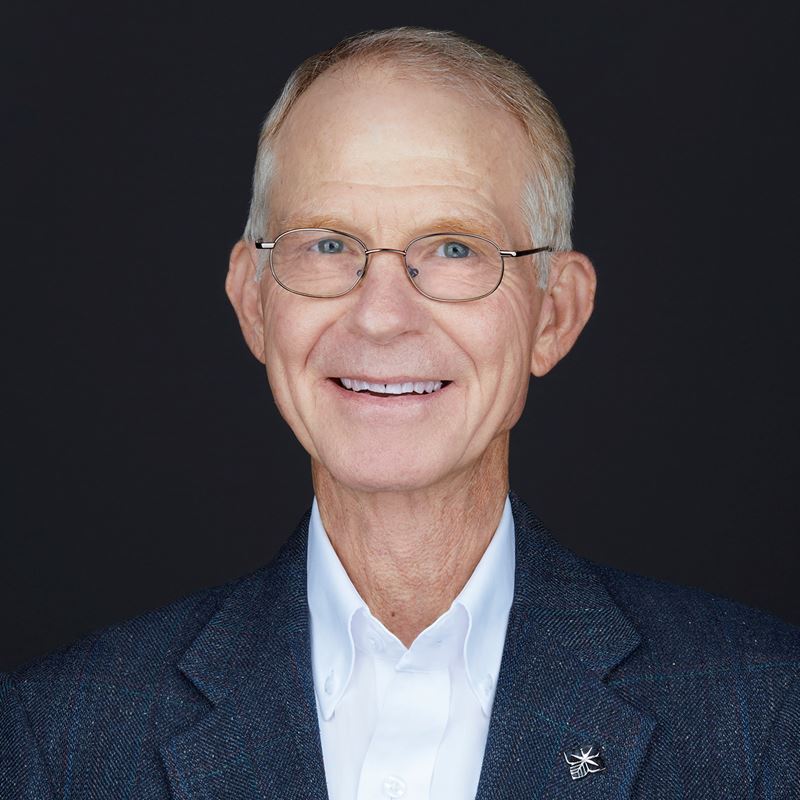

Bill Davis

Chief Executive Officer

Bill Davis

Chief Executive Officer

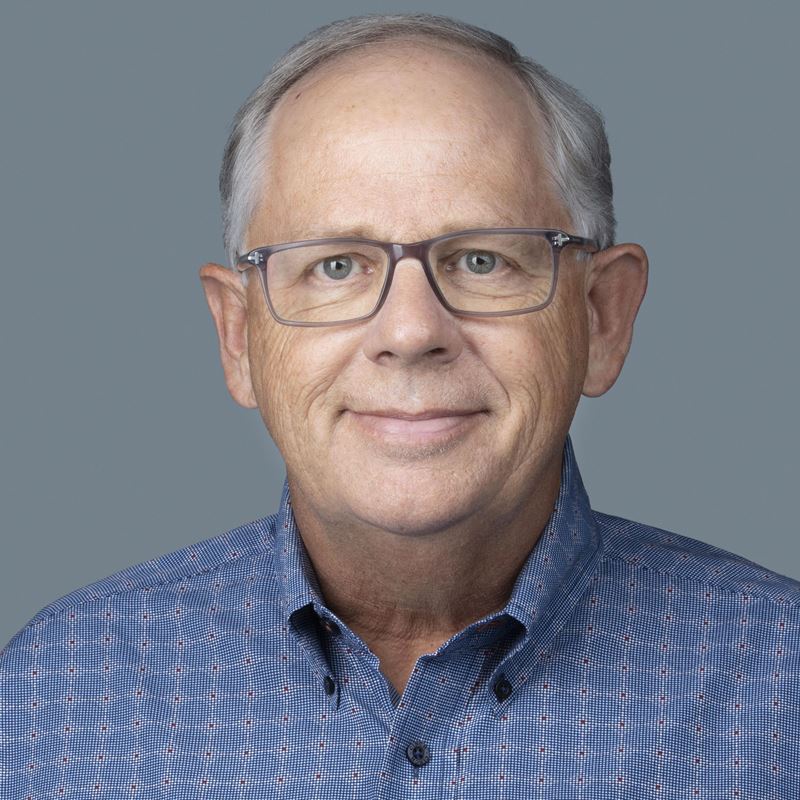

Steve Davenport

EVP/Chief Credit Officer

Steve Davenport

EVP/Chief Credit Officer

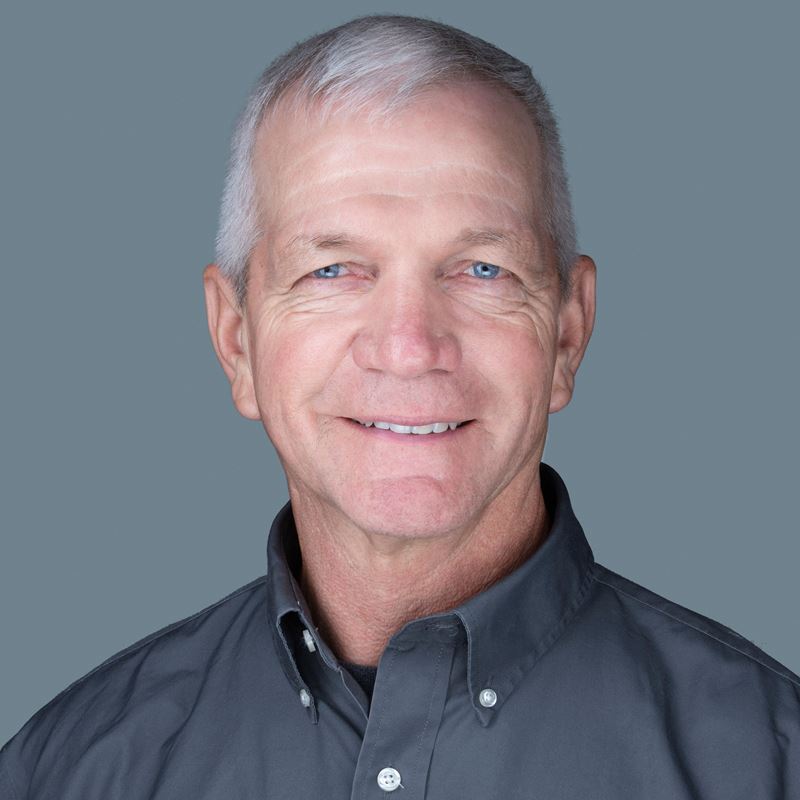

Joe Voth

Chief Risk Officer

Joe Voth

Chief Risk Officer

Malinda Thimmesch

Chief Financial Officer

Malinda Thimmesch

Chief Financial Officer

John Burk

Chief Lending Officer

John Burk

Chief Lending Officer

Ryan McBride

Chief Information Officer

Ryan McBride

Chief Information Officer

Board of Directors

View Board of Directors

Proudly supporting the rural communities we serve

We annually award scholarships to our members’ children. Ask your loan officer for details.

Career Opportunities

The Oklahoma AgCredit management team- from the bottom all the way to the top- supports and empowers me every day to be the best possible partner for the producers in my hometown.

Toni Dewitt - Loan Officer

View Open Positions